Cooperative Financial Network

Our cooperative model

Our cooperative model

Strength in numbers

Germany's local cooperative banks form one of the most extensive banking service networks in Europe, with 672 institutions and 7,207 branches.

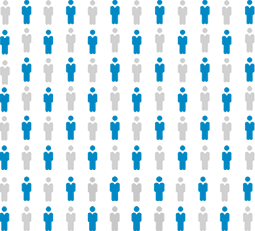

Membership

Of the banks' more than 30 million customers, 17,8 million are also members and therefore shareholders of their bank. This membership structure not only forms the basis for the legal form of a 'registered cooperative' (eingetragene Genossenschaft or eG). It also obliges the cooperative banks to advance their members' interests and gives members a say in the running of their bank. This is what makes cooperative banks different from all other banks.

Commitment to SMEs

The cooperative banking group traditionally feels a particularly strong obligation and connection to the wide range of small and medium-sized enterprises (SMEs) in Germany, the Mittelstand. Local cooperative banks were developed as self-help organizations for SMEs. These roots shape how they see themselves. The banks are committed to ensuring a strong and independent German Mittelstand and a culture of self-reliance, acting as a partner to them and providing them with finance.

Everything under one roof

Local cooperative banks are integrated financial institutions that offer their customers a wide range of financial services under one roof. This is possible thanks to their close collaboration with the highly effective specialized institutions in the Cooperative Financial Network, which include Bausparkasse Schwäbisch Hall, R+V Versicherung, and the asset management company Union Investment..

Local partners

As independent companies, the local cooperative banks are uniquely rooted in the economic life of their region. Their particular strengths are in-depth knowledge of the market and personal contact with local people

Cooperative diversity

The local cooperative banks are not the only institutions in the German banking sector with a 'registered cooperative' legal structure. The cooperative banking group also includes the Sparda banks, PSD banks, church banks, and other specialized institutions such as Deutsche Apotheker- und Ärztebank and BBBank.

Our Cooperative

Financial Network

Our Cooperative

Financial Network

Thanks to their partners in the Volksbanken Raiffeisenbanken Cooperative Financial Network, the cooperative banks are a local, one-stop shop for financial services. Like them, their partners are also committed to cooperative values such as solidarity, fairness, partnership, and the advancement of members' and customers' interests.

Cooperative service and technology companies

Facts and figures

Facts and figures

|

17,6 million

members have placed their trust in the local cooperative banks.

|

|

|

672 is the number of local cooperative banks.

|

|

|

136,900 people work for the local cooperative banks.

|

|

|

€1,208 billion is the sum of the local cooperative banks' total assets.

|

Our credit ratings

Our credit ratings

Vitality and financial stability

The Cooperative Financial Network is a major competitor in the German banking market, with consolidated total assets of €1,600 billion. It has documented its financial strength and unity by publishing annual consolidated financial statements.

Given the importance of external credit ratings in financial and capital markets, the BVR has commissioned the rating agencies Fitch Ratings and Standard & Poor's Ratings Services to assess the creditworthiness of the Cooperative Financial Network.

As a result, both agencies awarded a gratifying long-term rating compared to the industry, thus acknowledging the vitality and financial stability of the cooperative banking group's business model with its very strong market position in retail banking.

The credit ratings apply to the banks in the Cooperative Financial Network that are included in the assessment and can be broken down as follows:

| |

FitchRatings |

Standard & Poor`s |

| Long-term rating |

AA- |

A+ |

| Short-term rating |

F1+ |

A-1 |

| Individual rating |

aa- |

a+ |

| Outlook |

stable |

stable |

The detailed credit rating lists can be found on the agencies' websites.

Fitch Ratings

Standard & Poor`s