Consolidated Financial Statements 2018

Consolidated Financial Statements 2018

of the Volksbanken Raiffeisenbanken Cooperative Financial Network

Income statement for the period January 1 to December 31, 2018

| Note no. | 2018 € million | 2017 € million | ||

|---|---|---|---|---|

| Net interest income | 2. | 18,368 | 18,638 | |

| Interest income and current income and expenses | 23,659 | 25,227 | ||

| Interest expense | –5,291 | –6,589 | ||

| Net fee and commission income | 3. | 6,816 | 6,491 | |

| Fee and commission income | 7,989 | 7,811 | ||

| Fee and commission expenses | –1,173 | –1,320 | ||

| Gains and losses on trading activities | 4. | 461 | 709 | |

| Gains and losses on investments | 5. | –913 | –144 | |

| Loss allowances | 6. | –151 | –576 | |

| Other gains and losses on valuation of financial instruments | 7. | –122 | 289 | |

| Premiums earned | 8. | 15,997 | 15,181 | |

| Gains and losses on investments held by insurance companies and other insurance company gains and losses | 9. | 1,246 | 3,447 | |

| Insurance benefit payments | 10. | –14,208 | –15,312 | |

| Insurance business operating expenses | 11. | –2,172 | –2,033 | |

| Administrative expenses | 12. | –18,079 | –17,884 | |

| Other net operating income | 13. | 528 | 110 | |

| Profit before taxes | 7,771 | 8,916 | ||

| Income taxes | 14. | –2,369 | –2,843 | |

| Net profit | 5,402 | 6,073 | ||

Attributable to: | ||||

| Shareholders of the Cooperative Financial Network | 5,305 | 5,958 | ||

| Non-controlling interests | 97 | 115 |

Statement of comprehensive income for the period January 1 to December 31, 2018

| 2018 € million | 2017 € million | |

|---|---|---|

| Net profit | 5,402 | 6,073 |

| Other comprehensive income/loss | –453 | –208 |

| Items that may be reclassified to the income statement | –444 | –53 |

| Gains and losses on debt instruments measured at fair value through other comprehensive income | –655 | |

| Gains and losses on available-for-sale financial assets | –26 | |

| Gains and losses on cash flow hedges | –5 | 20 |

| Exchange differences on currency translation of foreign operations | 25 | –43 |

| Gains and losses on hedges of net investments in foreign operations | –6 | 23 |

| Share of other comprehensive income/loss of joint ventures and associates accounted for using the equity method | –12 | |

| Income taxes | 197 | –15 |

| Items that will not be reclassified to the income statement | –9 | –155 |

| Gains and losses on equity instruments for which the fair value OCI option has been exercised | –8 | |

| Gains and losses in relation to financial liabilities for which the fair value option has been exercised, attributable to changes in own credit risk | 35 | |

| Gains and losses arising from remeasurements of defined benefit plans | –42 | –231 |

| Income taxes | 6 | 76 |

| Total comprehensive income | 4,949 | 5,865 |

Attributable to: | ||

| Shareholders of the Cooperative Financial Network | 4,915 | 5,759 |

| Non-controlling interests | 34 | 106 |

Comparative information in accordance with IAS 39

Balance sheet as at December 31, 2018

| Assets | Note no. | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|---|

| Cash and cash equivalents | 15. | 75,169 | 63,6691 |

| Loans and advances to banks | 16. | 18,000 | 19,9672 |

| Loans and advances to customers | 16. | 794,916 | 761,880 |

| Hedging instruments (positive fair values) | 17. | 883 | 1,096 |

| Financial assets held for trading | 18. | 37,500 | 38,107 |

| Investments | 19. | 239,083 | 243,732 |

| Loss allowances | 20. | –8,988 | –7,363 |

| Investments held by insurance companies | 21. | 99,855 | 95,431 |

| Property, plant and equipment, and investment property | 22. | 12,241 | 11,731 |

| Income tax assets | 23. | 4,359 | 2,980 |

| Other assets | 24. | 19,359 | 12,086 |

| Total assets | 1,293,177 | 1,243,316 |

1 Adjustment by €+31,075 million due to change in presentation.

2 Adjustment by €-31,075 million due to change in presentation.

| Equity and liabilities | Note no. | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|---|

| Deposits from banks | 25. | 119,300 | 113,065 |

| Deposits from customers | 25. | 842,420 | 801,031 |

| Debt certificates issued including bonds | 26. | 56,111 | 64,807 |

| Hedging instruments (negative fair values) | 17. | 5,962 | 7,086 |

| Financial liabilities held for trading | 27. | 42,451 | 36,760 |

| Provisions | 28. | 12,562 | 12,562 |

| Insurance liabilities | 29. | 93,252 | 89,324 |

| Income tax liabilities | 23. | 1,408 | 1,183 |

| Other liabilities | 30. | 9,464 | 8,874 |

| Subordinated capital | 31. | 2,740 | 4,186 |

| Equity | 32. | 107,704 | 104,438 |

| Equity of the Cooperative Financial Network | 105,176 | 101,783 | |

| Subscribed capital | 12,332 | 11,930 | |

| Capital reserves | 722 | 722 | |

| Retained earnings | 85,954 | 81,446 | |

| Reserves from other comprehensive income | 863 | 1,676 | |

| Unappropriated earnings | 5,305 | 5,958 | |

| Non-controlling interests | 2,528 | 2,655 | |

| Total equity and liabilities | 1,293,177 | 1,243,316 |

Statement of changes in equity

€ million

| Subscribed capital | Capital reserves | Equity earned by the Cooperative Financial Network | Reserves from other comprehensive income | Equity of the Cooperative Financial Network | Non-controlling interests | Total equity | |

|---|---|---|---|---|---|---|---|

| Equity as at Jan. 1, 2017 | 11,443 | 696 | 81,963 | 1,784 | 95,886 | 2,683 | 98,569 |

| Net profit | – | – | 5,958 | – | 5,958 | 115 | 6,073 |

| Other comprehensive income/loss | – | – | –156 | –43 | –199 | –9 | –208 |

| Total comprehensive income | – | – | 5,802 | –43 | 5,759 | 106 | 5,865 |

| Issue and repayment of equity | 487 | 26 | – | – | 513 | –1 | 512 |

| Changes in the scope of consolidation | – | – | 14 | –14 | – | – | – |

| Acquisition/disposal of non-controlling interests | – | – | 39 | – | 39 | –80 | –41 |

| Dividends paid | – | – | –414 | – | –414 | –53 | –467 |

| Equity as at Dec. 31, 2017 | 11,930 | 722 | 87,404 | 1,727 | 101,783 | 2,655 | 104,438 |

| First-time application of IFRS 9 in the consolidated financial statements | – | – | –991 | –487 | –1,478 | –18 | –1,496 |

| Adjusted equity as at Jan. 1, 2018 | 11,930 | 722 | 86,413 | 1,240 | 100,305 | 2,637 | 102,942 |

| Net profit | – | – | 5,305 | – | 5,305 | 97 | 5,402 |

| Other comprehensive income/loss | – | – | –23 | –367 | –390 | –63 | –453 |

| Total comprehensive income | – | – | 5,282 | –367 | 4,915 | 34 | 4,949 |

| Issue and repayment of equity | 402 | – | – | – | 402 | –9 | 393 |

| Changes in the scope of consolidation | – | – | –11 | 12 | 1 | 4 | 5 |

| Acquisition/disposal of non-controlling interests | – | – | –16 | 11 | –5 | –92 | –97 |

| Reclassifications within equity | – | – | 33 | –33 | – | – | – |

| Dividends paid | – | – | –442 | – | –442 | –46 | –488 |

| Equity as at Dec. 31, 2018 | 12,332 | 722 | 91,259 | 863 | 105,176 | 2,528 | 107,704 |

The composition of equity is detailed in Note 32.

Statement of cash flows

| 2018 € million | 2017 € million | |

|---|---|---|

| Net profit | 5,402 | 6,073 |

| Non-cash items included in net profit and reconciliation to cash flows from operating activities | ||

| Depreciation, amortization, impairment losses, and reversal of impairment losses on assets, and other non-cash changes in financial assets and liabilities | 3,637 | –1,390 |

| Non-cash changes in provisions | 92 | –546 |

| Changes in insurance liabilities | 3,928 | 7,732 |

| Other non-cash income and expenses | 1,581 | 239 |

| Gains and losses on the disposal of assets and liabilities | 38 | 124 |

| Other adjustments (net) | –18,641 | –16,122 |

| Subtotal | –3,963 | –3,890 |

| Cash changes in assets and liabilities arising from operating activities | ||

| Loans and advances to banks and customers | –38,380 | –23,6431 |

| Other assets from operating activities | –1,338 | 200 |

| Derivative hedging instruments (positive and negative fair values) | –1,070 | –617 |

| Financial assets and financial liabilities held for trading | 6,792 | 3,944 |

| Deposits from banks and customers | 48,128 | 36,961 |

| Debt certificates issued including bonds | –8,597 | –6,111 |

| Other liabilities from operating activities | 28 | –1,690 |

| Interest, dividends and operating lease payments received | 25,778 | 26,808 |

| Interest paid | –5,979 | –8,022 |

| Income taxes paid | –2,735 | –1,637 |

| Cash flows from operating activities | 18,664 | 22,303 |

| Proceeds from the sale of investments | 18,920 | 20,184 |

| Proceeds from the sale of investments held by insurance companies | 23,658 | 20,224 |

| Payments for acquisitions of investments | –15,671 | –12,629 |

| Payments for acquisitions of investments held by insurance companies | –30,488 | –25,778 |

| Net payments for acquisitions of property, plant and equipment, and investment property (excl. assets subject to operating leases) | –1,141 | –1,525 |

| Net payments for acquisitions of intangible non-current assets | –245 | –40 |

| Changes in the scope of consolidation | 2 | 7 |

| Cash flows from investing activities | –4,965 | 443 |

| Proceeds from capital increases by shareholders of the Cooperative Financial Network | 402 | 513 |

| Dividends paid to shareholders of the Cooperative Financial Network | –442 | –414 |

| Dividends paid to non-controlling interests | –46 | –53 |

| Other payments to non-controlling interests | –9 | –1 |

| Net change in cash and cash equivalents from other financing activities (including subordinated capital) | –2,104 | –705 |

| Cash flows from financing activities | –2,199 | –660 |

| Cash and cash equivalents as at January 1 | 63,669 | 41,5832 |

| Cash flows from operating activities | 18,664 | 22,3033 |

| Cash flows from investing activities | –4,965 | 443 |

| Cash flows from financing activities | –2,199 | –660 |

| Cash and cash equivalents as at December 31 | 75,169 | 63,6694 |

1 Adjustment by €+14,913 million due to change in presentation.

2 Adjustment by €+16,162 million due to change in presentation.

3 Adjustment by €+14,913 million due to change in presentation.

4 Adjustment by €+31,075 million due to change in presentation.

The statement of cash flows shows the changes in cash and cash equivalents during the financial year. Cash and cash equivalents consist of cash on hand, balances with central banks and other government institutions. The cash reserve does not include any financial investments with maturities of more than three months at the date of acquisition. Changes in cash and cash equivalents are broken down into operating, investing and financing activities.

Cash flows from operating activities comprise cash flows mainly arising in connection with the revenue-generating activities of the Cooperative Financial Network or other activities that cannot be classified as investing or financing activities. Cash flows related to the acquisition and disposal of non-current assets are allocated to investing activities. Cash flows from financing activities include cash flows arising from transactions with equity owners and from other borrowings to finance business activities.

Notes to the consolidated financial statements

A General disclosures

Explanatory information on the consolidated financial statements

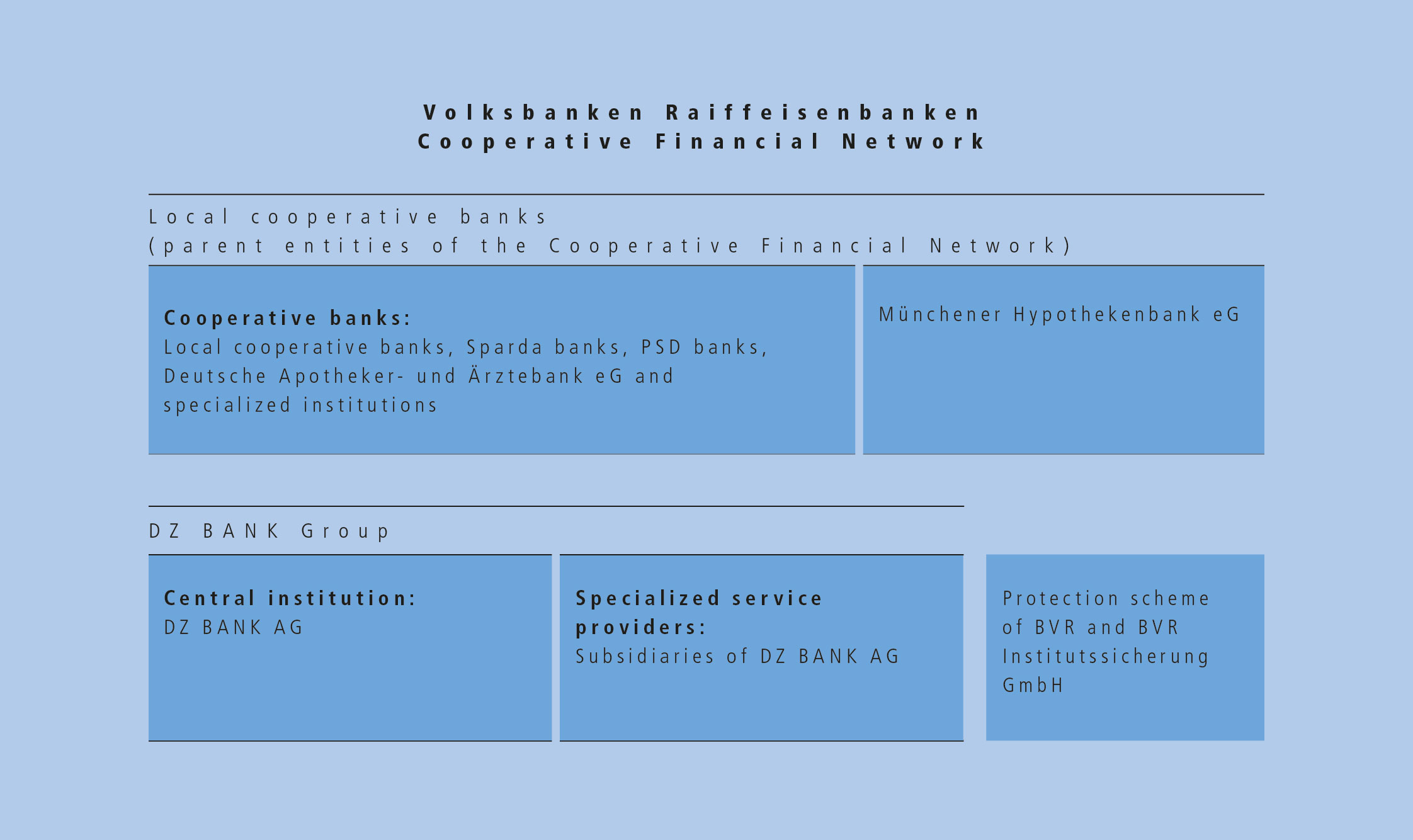

The consolidated financial statements of the Volksbanken Raiffeisenbanken Cooperative Financial Network prepared by the National Association of German Cooperative Banks (BVR) are based on the significant financial reporting principles set out in the annex. The cooperative shares and share capital of the local cooperative banks are held by their members. The local cooperative banks own the share capital of the central institution either directly or through intermediate holding companies. The Cooperative Financial Network does not qualify as a corporate group as defined by the International Financial Reporting Standards (IFRS), the German Commercial Code (HGB) or the German Stock Corporation Act (AktG).

These consolidated financial statements have been prepared for information purposes and to present the business development and performance of the Cooperative Financial Network, which is treated as a single economic entity in terms of its risks and strategies. In addition, the financial statements were prepared in order to comply with the provisions set out in article 113(7)(e) of Regulation (EU) No. 575/2013 of the European Parliament and of the Council of June 26, 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No. 648/2012 (Capital Requirements Regulation – CRR). These consolidated financial statements are not a substitute for analysis of the consolidated entities’ financial statements.

The underlying data presented in these consolidated financial statements is provided by the separate and consolidated financial statements of the entities in the Cooperative Financial Network and also includes data from supplementary surveys of the local cooperative banks. The consolidated financial statements of DZ BANK included in these consolidated financial statements have been prepared on the basis of IFRS as adopted by the European Union.

The financial year corresponds to the calendar year. The consolidated entities have generally prepared their financial statements on the basis of the financial year ended December 31, 2018. There is one

subsidiary (2017: 1 subsidiary) included in the consolidated financial statements with a different reporting date for its annual financial statements. With 47 exceptions (2017: 40 exceptions), the separate financial statements of the entities accounted for using the equity method are prepared using the same balance sheet date as that of the consolidated financial statements.

In the interest of clarity, some items on the face of the balance sheet and the income statement have been aggregated and are explained by additional disclosures.

Information as regards the significant financial reporting principles can be found in the annex to the consolidated financial statements.

Change in accounting policies

As at January 1, 2018, the rules of IFRS 9 Financial Instruments replaced the rules of IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 includes the requirements for the substantially revised subject areas of classification and measurement of financial instruments, accounting for impairment of financial instruments as well as hedge accounting. The modified implementation of these rules in the consolidated financial statements is described in the Annex “Significant Financial Reporting Principles” in the section “Financial instruments.”

Upon the transition to IFRS 9 in the consolidated financial statements, changes in presentation were introduced in relation to various elements of the consolidated financial statements. The major changes in presentation are described in the following section in the order of their occurrence in the consolidated financial statements:

In order to reduce the increased complexity of the presentation of the components of reserves from other comprehensive income caused by the introduction of IFRS 9, these components will be combined and presented in one single column in the statement of changes in equity. The individual equity components are presented in the disclosures on equity in Note 32.

In contrast to the previous procedure applicable under IAS 39, the loss allowance determined in accordance with IFRS 9 is reported within all of the balance sheet items on a gross basis in the consolidated financial statements for financial instruments of the category “financial assets measured at amortized cost,” except for the balance sheet item “Investments held by insurance companies.” Accordingly, financial instruments are also presented on a gross basis within the balance sheet item “Investments” in accordance with IFRS 9. As a consequence, the loss allowance for financial assets measured at amortized cost is reported in the balance sheet below the line item “Investments.” Accordingly, the loss allowance is presented in the income statement below the item “Gains and losses on investments.” The loss allowance for financial instruments of the category “Financial assets measured at fair value through other comprehensive income” is reported in equity as part of the changes in reserves from other comprehensive income.

The modified retrospective application of IFRS 9 had the following effects on the balance sheet items of the consolidated financial statements as at the date of first-time application January 1, 2018:

The first-time application of the IFRS 9 rules led to a reduction in equity after taxes by €1,496 million as at the date of first-time application January 1, 2018. Of that amount, a decrease of €991 million was attributable to retained earnings, a decrease of €487 million to the reserve from other comprehensive income and a decrease of €18 million to non-controlling interests. The reduction in equity primarily results from the increase in loss allowances by €2,340 million. The reason for this is the assessment of expected credit losses over the entire lifetime as required under IFRS 9.

Scope of consolidation

The consolidated financial statements comprise, as consolidated entities, 875 cooperative banks (2017: 915) as well as all companies included in the consolidated financial statements of DZ BANK, Münchener Hypothekenbank eG (MHB), the BVR protection scheme, and BVR Institutssicherung GmbH. The consolidated cooperative banks include Deutsche Apotheker- und Ärztebank eG, the Sparda banks, the PSD banks, and specialized institutions such as BAG Bankaktiengesellschaft.

The cooperative banks and MHB are the legally independent, horizontally structured parent entities of the Cooperative Financial Network, whereas the other companies and the DZ BANK Group are consolidated as subsidiaries. The cooperative central institution and a total of 390 subsidiaries (2017: 434) have been consolidated in the DZ BANK Group. Further information on the shareholdings can be found in the list of shareholdings included in the annual report of the DZ BANK Group.

The consolidated financial statements include 20 joint ventures between a consolidated entity and at least one other non-network entity (2017: 21) and 44 associates (2017: 44) over which a consolidated entity has significant influence, that are accounted for using the equity method.

| Assets | Dec. 31, 2017 € million | Adjustment amount | Jan. 1, 2018 € million |

|---|---|---|---|

| Cash and cash equivalents | 63,6691 | – | 63,669 |

| Loans and advances to banks | 19,9672 | 189 | 20,156 |

| Loans and advances to customers | 761,880 | 743 | 762,623 |

| Hedging instruments (positive fair values) | 1,096 | –18 | 1,078 |

| Financial assets held for trading | 38,107 | –1,019 | 37,088 |

| Investments | 243,732 | –657 | 243,075 |

| Loss allowances | –7,363 | –2,340 | –9,703 |

| Investments held by insurance companies | 95,431 | 2,021 | 97,452 |

| Property, plant and equipment, and investment property | 11,731 | – | 11,731 |

| Income tax assets | 2,980 | 719 | 3,699 |

| Other assets | 12,086 | 665 | 12,751 |

| Total assets | 1,243,316 | 303 | 1,243,619 |

1 Adjustment by €+31,075 million due to change in presentation.

2 Adjustment by €–31,075 million due to change in presentation.

| Equity and liabilities | Dec. 31, 2017 € million | Adjustment amount | Jan. 1, 2018 € million |

|---|---|---|---|

| Deposits from banks | 113,065 | 61 | 113,126 |

| Deposits from customers | 801,031 | –131 | 800,900 |

| Debt certificates issued including bonds | 64,807 | –683 | 64,124 |

| Hedging instruments (negative fair values) | 7,086 | 275 | 7,361 |

| Financial liabilities held for trading | 36,760 | 540 | 37,300 |

| Provisions | 12,562 | 68 | 12,630 |

| Insurance liabilities | 89,324 | 1,694 | 91,018 |

| Income tax liabilities | 1,183 | 93 | 1,276 |

| Other liabilities | 8,874 | –107 | 8,767 |

| Subordinated capital | 4,186 | –11 | 4,175 |

| Equity | 104,438 | –1,496 | 102,942 |

| Equity of the Cooperative Financial Network | 101,783 | –1,478 | 100,305 |

| Subscribed capital | 11,930 | – | 11,930 |

| Capital reserves | 722 | – | 722 |

| Retained earnings | 81,446 | –991 | 80,455 |

| Reserves from other comprehensive income | 1,676 | –487 | 1,240 |

| Unappropriated earnings | 5,958 | – | 5,958 |

| Non-controlling interests | 2,655 | –18 | 2,637 |

| Total equity and liabilities | 1,243,316 | 303 | 1,243,619 |

B Selected disclosures of interests in other entities

Investments in subsidaries

Share in the business operations of the Cooperative Financial Network attributable to non-controlling interests

DZ BANK AG Deutsche Zentral-Genossenschaftsbank (DZ BANK) and its subsidiaries are included together in the consolidated financial statements as a subgroup. DZ BANK is focused on its customers and owners, the local cooperative banks, as central institution, commercial bank and holding company. The objective of this focus is to sustainably expand the position of the Cooperative Financial Network as one of the leading bancassurance groups.

The shares of DZ BANK, with its headquarters in Frankfurt/Main, Germany, are held by the cooperative banks and by MHB, with ownership interests amounting to 94.6 percent (2017: 94.5 percent). The remaining shares of 5.4 percent (2017: 5.5 percent) are attributable to shareholders that are not part of the Cooperative Financial Network. The prorata share in net profit attributable to non-controlling interests amounted to €97 million (2017: €115 million). The carrying amount of non-controlling interests amounted to €2,528 million (2017: €2,655 million). In the financial year under review, the dividend payment made to non-controlling interests amounts to €46 million (2017: €53 million).

Nature and extent of significant restrictions

National regulatory requirements, contractual provisions, and provisions of company law restrict the ability of the DZ BANK Group companies included in the consolidated financial statements to transfer assets within the group. Where restrictions can be specifically assigned to individual line items on the balance sheet, the carrying amounts of the assets and liabilities subject to restrictions on the balance sheet date are shown in the following table:

| Dec. 31, 2018 € million | Dec. 31, 2017 € million | |

|---|---|---|

| Assets | 85,850 | 81,559 |

| Loans and advances to customers | 2,689 | 2,812 |

| Investments | 5 | 5 |

| Investments held by insurance companies | 83,152 | 78,738 |

| Other assets | 4 | 4 |

| Liabilities | 140,359 | 132,474 |

| Deposits from banks | 1,793 | 1,776 |

| Deposits from customers | 59,996 | 56,642 |

| Provisions | 1,072 | 983 |

| Insurance liabilities | 77,498 | 73,073 |

Nature of the risks associated with interests in consolidated structured entities

Risks arising from interests in consolidated structured entities largely result from loans to fully consolidated funds within the DZ BANK Group, some of which are extended in the form of junior loans.

Interests in joint arrangements and associates

Nature, extent, and financial effects of interests in joint arrangements

The carrying amount of individually immaterial joint ventures accounted for using the equity method totaled €462 million as at the balance sheet date (2017: €522 million).

Aggregated financial information for equityaccounted joint ventures that, individually, are not material:

| 2018 € million | 2017 € million | |

|---|---|---|

| Share of profit/loss from continuing operations | 76 | 83 |

| Share of other comprehensive income/loss | –8 | –36 |

| Share of total comprehensive income | 68 | 47 |

Nature, extent and financial effects of interests in associates

The carrying amount of individually immaterial associates accounted for using the equity method totaled €288 million as at the balance sheet date (2017: €315 million).

Aggregated financial information for equityaccounted associates that, individually, are not material:

| 2018 € million | 2017 € million | |

|---|---|---|

| Share of profit/loss from continuing operations | 5 | –44 |

| Share of other comprehensive income/loss | – | 6 |

| Share of total comprehensive income | 5 | –38 |

Interests in unconsolidated structured entities

Structured entities are entities that have been designed so that voting rights or similar rights are not the dominant factor in deciding who controls the entity. The Cooperative Financial Network mainly distinguishes between the following types of interests in unconsolidated structured entities, based on their design and the related risks; these entities largely concern companies of the DZ BANK Group:

- Interests in investment funds issued by the Cooperative Financial Network

- Interests in investment funds not issued by the Cooperative Financial Network

- Interests in securitization vehicles

- Interests in asset-leasing vehicles

Interests in investment funds issued by the Cooperative Financial Network

The interests in the investment funds issued by the Cooperative Financial Network largely comprise investment funds issued by entities in the Union Investment Group in accordance with the contractual form model without voting rights and, to a lesser extent, those that are structured as a company with a separate legal personality. Furthermore, the DVB Bank Group makes subordinated loans available to fully consolidated funds for the purpose of transport finance. In turn, these funds make subordinated loans or direct equity investments available to unconsolidated entities.

The maximum exposure of the investment funds issued and managed by the Cooperative Financial Network is determined as a gross value, excluding deduction of available collateral, and amounts to €8,855 million as at the reporting date (2017: €10,051 million). These investment fund assets resulted in losses of €85 million (2017: losses of €77 million) as well as income of €2,192 million (2017: €1,984 million).

Interests in investment funds not issued by the Cooperative Financial Network

The interests in the investment funds not issued by the Cooperative Financial Network above all comprise investment funds managed by entities in the Union Investment Group within the scope of their own decision-making powers that have been issued by entities outside the Cooperative Financial Network and parts of such investment funds. Their total volume amounted to €37,405 million (2017: €37,852 million). Moreover, loans to investment funds are extended in order to generate interest income. In addition, there are investment funds issued by entities outside the Cooperative Financial Network in connection with unit-linked life insurance of the R+V Group (R+V) amounting to €7,244 million (2017: €7,498 million) that, however, do not result in a maximum exposure.

The maximum exposure arising of the investment funds not issued by the Cooperative Financial Network is determined as a gross value, excluding deduction of available collateral, and amounts to €4,493 million as at the reporting date (2017: €4,022 million). Income generated from these investment fund assets in the financial year 2018 amounted to €154 million (2017: €133 million).

Interests in securitization vehicles

The interests in securitization vehicles are interests in vehicles where the Cooperative Financial Network involvement goes beyond that of an investor.

The material interests in securitization vehicles comprise the two multi-seller asset-backed commercial paper programs: CORAL and AUTOBAHN. DZ BANK acts as sponsor and program agent for both programs. It is also the program administrator for AUTOBAHN.

The maximum exposure of the interests in securitization vehicles in the Cooperative Financial Network is determined as a gross value, excluding deduction of available collateral, and amounts to €3,895 million as at the reporting date (2017: €3,983 million). Income generated from these interests in the financial year 2018 amounted to €48 million (2017: €56 million).

Interests in asset-leasing vehicles

The interests in asset-leasing vehicles comprise shares in limited partnerships and voting rights, other than the shares in limited partnerships established by VR LEASING for the purpose of real estate leasing (asset-leasing vehicles), in which the asset, and the funding occasionally provided by the DZ BANK Group, are placed.

The actual maximum exposure of the interests in asset-leasing vehicles in the Cooperative Financial Network is determined as a gross value, excluding deduction of available collateral, and amounts to minus €4 million (2017: minus €13 million) as at the reporting date. As in the previous year, interest income and current income and expense generated from these interests amounted to €5 million.

C Income statement disclosures

| 1. Information on operating segments Financial year 2018 € million | Retail Customers and SMEs1 | Central Institution and Major Corporate Customers2 | Real Estate Finance | Insurance | Other/Consolidation | Total |

|---|---|---|---|---|---|---|

| Net interest income | 16,321 | 1,371 | 1,423 | – | –747 | 18,368 |

| Net fee and commission income | 6,918 | 550 | –110 | – | –542 | 6,816 |

| Gains and losses on trading activities | 195 | 267 | 1 | – | –2 | 461 |

| Gains and losses on investments | –1,130 | 195 | 6 | – | 16 | –913 |

| Loss allowances | –232 | 70 | 2 | – | 9 | –151 |

| Other gains and losses on valuation of financial instruments | –34 | 79 | –16 | – | 7 | –122 |

| Premiums earned | – | – | – | 15,997 | – | 15,997 |

| Gains and losses on investments held by insurance companies and other insurance company gains and losses | – | – | – | 1,342 | –96 | 1,246 |

| Insurance benefit payments | – | – | – | –14,208 | – | –14,208 |

| Insurance business operating expenses | – | – | – | –2,721 | 549 | –2,172 |

| Administrative expenses | –15,386 | –1,944 | –885 | – | 136 | –18,079 |

| Other net operating expense/income | 274 | 1 | 56 | 3 | 194 | 528 |

| Profit/loss before taxes | 6,926 | 431 | 477 | 413 | –476 | 7,771 |

| Cost/income ratio (percent) | 68.2 | 84.3 | 65.1 | – | – | 69.5 |

| Financial year 2017 € million | Retail Customers and SMEs1 | Central Institution and Major Corporate Customers2 | Real Estate Finance | Insurance | Other/Consolidation | Total |

|---|---|---|---|---|---|---|

| Net interest income | 16,489 | 1,525 | 1,492 | – | –868 | 18,638 |

| Net fee and commission income | 6,646 | 519 | –122 | – | –522 | 6,491 |

| Gains and losses on trading activities | 213 | 485 | 11 | – | – | 709 |

| Gains and losses on investments | –174 | –17 | 25 | – | 22 | –144 |

| Loss allowances | 95 | –693 | 12 | – | 10 | –576 |

| Other gains and losses on valuation of financial instruments | 20 | –10 | 292 | – | –13 | 289 |

| Premiums earned | – | – | – | 15,181 | – | 15,181 |

| Gains and losses on investments held by insurance companies and other insurance company gains and losses | – | – | – | 3,531 | –84 | 3,447 |

| Insurance benefit payments | – | – | – | –15,312 | – | –15,312 |

| Insurance business operating expenses | – | – | – | –2,595 | 562 | –2,033 |

| Administrative expenses | –15,245 | –1,969 | –804 | – | 134 | –17,884 |

| Other net operating expense/income | 44 | 67 | 22 | –10 | –13 | 110 |

| Profit/loss before taxes | 8,088 | –93 | 928 | 795 | –802 | 8,916 |

| Cost/income ratio (percent) | 65.6 | 76.6 | 46.7 | – | – | 65.3 |

1 The operating segment “Retail Customers and SMEs” was previously named “Retail.” The segment’s composition has not changed.

2 The operating segment “Central Institution and Major Corporate Customers” was previously named “Bank.” The segment’s composition has not changed.

Definition of operating segments

The Volksbanken Raiffeisenbanken Cooperative Financial Network is founded on the underlying principle of decentralization. It is based on the local primary banks, whose business activities are supported by the central institution – DZ BANK – and by specialized service providers within the cooperative sector. These specialized service providers are integrated into the central institution. The main benefit derived by the primary banks from their collaboration with these specialized services providers and the central institution is that they can offer a full range of financial products and services.

The operating segment “Retail Customers and SMEs” (2017: “Retail”) covers private banking and activities relating to asset management. The segment focuses on retail clients. It mainly includes cooperative banks as well as the DZ PRIVATBANK, TeamBank AG Nürnberg (TeamBank) and Union Investment Group.

The operating segment “Central Institution and Major Corporate Customers” (2017: “Bank”) combines the activities of the Cooperative Financial Network in the corporate customers, institutional customers and capital markets businesses. The operating segment focuses on corporate customers. It essentially comprises DZ BANK, the VR LEASING Group and DVB Bank Group.

The Real Estate Finance operating segment encompasses the buildings society operations, mortgage banking, and real estate business. The entities allocated to this operating segment include the Bausparkasse Schwäbisch Hall Group (BSH), Deutsche Genossenschafts-Hypothekenbank AG (DZ HYP), and MHB.

Insurance operations are reported under the Insurance operating segment. This operating segment consists solely of R+V.

Other/Consolidation contains the BVR protection scheme (BVR-SE) as well as BVR Institutssicherung GmbH (BVR-ISG), whose task is to avert impending or existing financial difficulties faced by member institutions by taking preventive action or implementing restructuring measures. This operating segment also includes intersegment consolidation items.

Presentation of the disclosures on operating segments

The information on operating segments presents the interest income generated by the operating segments and the associated interest expenses on a netted basis as net interest income.

Intersegment consolidation

The adjustments to the figure for net interest income resulted largely from the consolidation of dividends paid within the Cooperative Financial Network.

The figure under Other/Consolidation for net fee and commission income relates specifically to the fee and commission business transacted between the primary banks, TeamBank, BSH, and R+V.

The figure under Other/Consolidation for administrative expenses includes the contributions paid to BVR-SE and BVR-ISG by member institutions of the Cooperative Financial Network.

The remaining adjustments are largely attributable to the consolidation of income and expenses.

| 2. Net interest income | 2018 € million | 2017 € million |

|---|---|---|

| Interest income and current income and expense | 23,659 | 25,227 |

| Interest income from | 22,463 | 23,929 |

| Lending and money market business | 21,222 | 22,204 |

| of which: Building society operations | 1,044 | 1,032 |

| Finance leases | 113 | 126 |

| Fixed-income securities | 2,080 | 2,456 |

| Other assets | –541 | –624 |

| Financial assets with a negative effective interest rate | –298 | –107 |

| Current income from | 1,113 | 1,197 |

| Shares and other variable-yield securities | 973 | 1,168 |

| Investments in subsidiaries and equity investments | 141 | 92 |

| Operating leases | –1 | –63 |

| Income / loss from using the equity method for | 38 | 41 |

| Investments in joint ventures | 24 | 40 |

| Investments in associates | 14 | 1 |

| Income from profit-pooling, profit-transfer and partial profit-transfer agreements | 45 | 60 |

| Interest expense | –5,291 | –6,589 |

| Interest expense on | –5,058 | –6,279 |

| Deposits from banks and customers | –4,530 | –5,336 |

| of which: Building society operations | –828 | –822 |

| Debt certificates issued including bonds | –820 | –993 |

| Subordinated capital | –172 | –224 |

| Other liabilities | 130 | 172 |

| Financial liabilities with a positive effective interest rate | 334 | 102 |

| Other interest expense | –233 | –310 |

| Total | 18,368 | 18,638 |

The interest income from other assets and the interest expense on other liabilities result from gains and losses on the amortization of fair value changes of the hedged items in portfolio hedges of interest-rate risk. Owing to the current low level of interest rates in the money markets and capital markets, there may be a negative effective interest rate for financial assets and a positive effective interest rate for financial liabilities.

| 3. Net fee and commission income | 2018 € million | 2017 € million |

|---|---|---|

| Fee and commission income | 7,989 | 7,811 |

| Securities business | 3,499 | 3,609 |

| Asset management | 423 | 397 |

| Payments processing including card processing | 2,746 | 2,627 |

| Lending business and trust activities | 174 | 158 |

| Financial guarantee contracts and loan commitments | 171 | 173 |

| International business | 132 | 129 |

| Building society operations | 31 | 25 |

| Other | 813 | 693 |

| Fee and commission expenses | –1,173 | –1,320 |

| Securities business | –342 | –481 |

| Asset management | –121 | –124 |

| Payments processing including card processing | –215 | –243 |

| Lending business | –55 | –97 |

| Financial guarantee contracts and loan commitments | –22 | –17 |

| International business | –24 | –28 |

| Building society operations | –69 | –60 |

| Other | –325 | –270 |

| Total | 6,816 | 6,491 |

| 4. Gains and losses on trading activities | 2018 € million | 2017 € million |

|---|---|---|

| Gains and losses on trading in financial instruments | 179 | 217 |

| Gains and losses on trading in foreign exchange, foreign notes and coins, and precious metals | 104 | 311 |

| Gains and losses on commodities trading | 178 | 181 |

| Total | 461 | 709 |

| 5. Gains and losses on investments | 2018 € million | 2017 € million |

|---|---|---|

| Gains and losses on securities | -1,034 | -239 |

| Gains and losses on investments in subsidiaries and equity investments | 121 | 95 |

| Total | -913 | -144 |

| 6. Loss allowances | 2018 € million | 2017 € million |

|---|---|---|

| Additions | –3,453 | –2,636 |

| Reversals | 3,061 | 1,881 |

| Directly recognized impairment losses | –110 | –155 |

| Recoveries on loans and advances previously impaired | 232 | 289 |

| Other | 18 | – |

| Changes in the provisions for loan commitments, provisions for financial guarantee contracts and other provisions for loans and advances | 101 | 45 |

| Total | –151 | –576 |

| 7. Other gains and losses on valuation of financial instruments | 2018 € million | 2017 € million |

|---|---|---|

| Gains and losses from hedge accounting | –21 | –27 |

| Fair value hedges | –22 | –27 |

| Ineffectiveness of hedges of net investments in foreign operations | 1 | – |

| Gains and losses on derivatives held for purposes other than trading | –53 | –15 |

| Gains and losses on financial instruments designated as at fair value through profit or loss | –37 | 331 |

| Gains and losses from contingent consideration in business combinations | –11 | – |

| Total | –122 | 289 |

| 8. Premiums earned | 2018 € million | 2017 € million |

|---|---|---|

| Net premiums written | 16,009 | 15,235 |

| Gross premiums written | 16,133 | 15,338 |

| Reinsurance premiums ceded | –124 | –103 |

| Change in provision for unearned premiums | –12 | –54 |

| Gross premiums | –7 | –59 |

| Reinsurers’ share | –5 | 5 |

| Total | 15,997 | 15,181 |

| 9. Gains and losses on investments held by insurance companies and other insurance company gains and losses | 2018 € million | 2017 € million |

|---|---|---|

| Interest income and current income | 2,411 | 2,521 |

| Administrative expenses | –150 | –131 |

| Gains and losses on valuation and disposals as well as from additions to and reversals of loss allowances | –1,187 | 773 |

| Other gains and losses of insurance companies | 172 | 284 |

| Total | 1,246 | 3,447 |

The net amount of additions to and reversals of loss allowances recorded in the fiscal year was €1 million.

| 10. Insurance benefit payments | 2018 € million | 2017 € million |

|---|---|---|

| Expenses for claims | –10,742 | –10,138 |

| Gross expenses for claims | –10,786 | –10,161 |

| Reinsurers’ share | 44 | 23 |

| Changes in benefit reserve, reserve for premium refunds, and in other insurance liabilities | –3,466 | –5,174 |

| Changes in gross provisions | –3,483 | –5,171 |

| Reinsurers’ share | 17 | –3 |

| Total | –14,208 | –15,312 |

Claims rate trend for direct non-life insurance business including claim settlement costs

Gross claims provisions in direct business and payments made against the original provisions:

| € million | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| At the end of the year | 4,551 | 4,276 | 4,173 | 3,856 | 3,634 | 3,901 | 3,345 | 3,341 | 3,324 | 2,953 | 2,704 |

| 1 year later | – | 4,142 | 4,103 | 3,767 | 3,523 | 3,847 | 3,336 | 3,359 | 3,135 | 2,901 | 2,623 |

| 2 years later | – | – | 4,046 | 3,682 | 3,457 | 3,769 | 3,247 | 3,279 | 3,160 | 2,763 | 2,527 |

| 3 years later | – | – | – | 3,647 | 3,389 | 3,731 | 3,220 | 3,254 | 3,139 | 2,756 | 2,533 |

| 4 years later | – | – | – | – | 3,382 | 3,696 | 3,189 | 3,241 | 3,122 | 2,756 | 2,505 |

| 5 years later | – | – | – | – | – | 3,691 | 3,198 | 3,250 | 3,139 | 2,768 | 2,513 |

| 6 years later | – | – | – | – | – | – | 3,126 | 3,183 | 3,080 | 2,710 | 2,469 |

| 7 years later | – | – | – | – | – | – | – | 3,172 | 3,065 | 2,685 | 2,466 |

| 8 years later | – | – | – | – | – | – | – | – | 3,060 | 2,680 | 2,449 |

| 9 years later | – | – | – | – | – | – | – | – | – | 2,680 | 2,447 |

| 10 years later | – | – | – | – | – | – | – | – | – | – | 2,449 |

| Settlements | – | 134 | 127 | 209 | 252 | 210 | 219 | 169 | 264 | 273 | 255 |

Net claims provisions in direct business and payments made against the original provisions:

| € million | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|

| At the end of the year | 4,518 | 4,255 | 4,110 | 3,827 | 3,574 | 3,669 | 3,313 | 3,298 | 3,254 |

| 1 year later | – | 4,118 | 4,050 | 3,736 | 3,460 | 3,613 | 3,300 | 3,317 | 3,056 |

| 2 years later | – | – | 3,994 | 3,655 | 3,393 | 3,533 | 3,211 | 3,236 | 3,077 |

| 3 years later | – | – | – | 3,624 | 3,331 | 3,490 | 3,180 | 3,208 | 3,057 |

| 4 years later | – | – | – | – | 3,361 | 3,465 | 3,139 | 3,194 | 2,939 |

| 5 years later | – | – | – | – | – | 3,670 | 3,166 | 3,191 | 3,049 |

| 6 years later | – | – | – | – | – | – | 3,095 | 3,144 | 2,957 |

| 7 years later | – | – | – | – | – | – | – | 3,134 | 2,957 |

| 8 years later | – | – | – | – | – | – | – | – | 2,977 |

| Settlements | – | 137 | 116 | 203 | 213 | –1 | 218 | 164 | 277 |

Claims rate trend for inward reinsurance business

Gross claims provisions in inward reinsurance business and payments made against the original provisions:

| € million | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Gross provisions for claims outstanding | 3,642 | 3,197 | 2,718 | 2,433 | 1,976 | 1,710 | 1,506 | 1,409 | 1,190 | 892 | 712 |

| Cumulative payments for the year concerned and prior years | |||||||||||

| 1 year later | – | 852 | 569 | 622 | 464 | 481 | 385 | 463 | 437 | 282 | 232 |

| 2 years later | – | – | 852 | 867 | 783 | 685 | 630 | 640 | 632 | 399 | 347 |

| 3 years later | – | – | – | 919 | 897 | 764 | 345 | 739 | 468 | 410 | 250 |

| 4 years later | – | – | – | – | 1,026 | 987 | 930 | 891 | 856 | 516 | 447 |

| 5 years later | – | – | – | – | – | 1,051 | 996 | 1,029 | 922 | 588 | 475 |

| 6 years later | – | – | – | – | – | – | 1,035 | 1,072 | 1,043 | 626 | 528 |

| 7 years later | – | – | – | – | – | – | – | 1,103 | 1,067 | 652 | 555 |

| 8 years later | – | – | – | – | – | – | – | – | 1,090 | 658 | 574 |

| 9 years later | – | – | – | – | – | – | – | – | – | 684 | 585 |

| 10 years later | – | – | – | – | – | – | – | – | – | – | 597 |

| Gross provisions for claims outstanding and payments made against the original provision | |||||||||||

| At the end of the year | 3,642 | 3,197 | 2,718 | 2,433 | 1,976 | 1,710 | 1,506 | 1,409 | 1,190 | 892 | 712 |

| 1 year later | – | 3,392 | 2,654 | 2,434 | 2,157 | 1,840 | 1,593 | 1,536 | 1,401 | 1,026 | 779 |

| 2 years later | – | – | 2,561 | 2,271 | 2,004 | 1,859 | 1,569 | 1,472 | 1,343 | 872 | 765 |

| 3 years later | – | – | – | 2,224 | 1,915 | 1,779 | 1,628 | 1,014 | 1,338 | 826 | 696 |

| 4 years later | – | – | – | – | 1,887 | 1,720 | 1,580 | 1,528 | 1,360 | 837 | 680 |

| 5 years later | – | – | – | – | – | 1,699 | 1,550 | 1,501 | 1,396 | 858 | 691 |

| 6 years later | – | – | – | – | – | – | 1,536 | 1,486 | 1,379 | 870 | 709 |

| 7 years later | – | – | – | – | – | – | – | 1,481 | 1,368 | 876 | 719 |

| 8 years later | – | – | – | – | – | – | – | – | 1,354 | 873 | 725 |

| 9 years later | – | – | – | – | – | – | – | – | – | 864 | 725 |

| 10 years later | – | – | – | – | – | – | – | – | – | – | 723 |

| Settlements | – | –195 | 157 | 209 | 89 | 11 | –30 | –72 | –164 | 28 | –11 |

Net claims provisions in inward reinsurance business and payments made against the original provisions:

| € million | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|

| Net provisions for claims outstanding | 3,639 | 3,193 | 2,710 | 2,428 | 1,970 | 1,695 | 1,491 | 1,389 | 1,164 |

| Cumulative payments for the year concerned and prior years | |||||||||

| 1 year later | – | 851 | 567 | 622 | 464 | 473 | 383 | 461 | 432 |

| 2 years later | – | – | 849 | 866 | 782 | 677 | 620 | 636 | 625 |

| 3 years later | – | – | – | 1,020 | 918 | 888 | 754 | 333 | 729 |

| 4 years later | – | – | – | – | 1,025 | 978 | 919 | 878 | 839 |

| 5 years later | – | – | – | – | – | 1,042 | 985 | 1,016 | 904 |

| 6 years later | – | – | – | – | – | – | 1,024 | 1,059 | 1,025 |

| 7 years later | – | – | – | – | – | – | – | 1,090 | 1,049 |

| 8 years later | – | – | – | – | – | – | – | – | 1,071 |

| Net provisions for claims outstanding and payments made against the original provision | |||||||||

| At the end of the year | 3,639 | 3,193 | 2,710 | 2,428 | 1,970 | 1,695 | 1,491 | 1,389 | 1,164 |

| 1 year later | – | 3,388 | 2,648 | 2,429 | 2,152 | 1,827 | 1,576 | 1,519 | 1,377 |

| 2 years later | – | – | 2,555 | 2,267 | 1,999 | 1,845 | 1,554 | 1,454 | 1,321 |

| 3 years later | – | – | – | 2,219 | 1,911 | 1,766 | 1,612 | 997 | 1,314 |

| 4 years later | – | – | – | – | 1,883 | 1,708 | 1,566 | 1,510 | 1,337 |

| 5 years later | – | – | – | – | – | 1,687 | 1,536 | 1,484 | 1,372 |

| 6 years later | – | – | – | – | – | – | 1,522 | 1,470 | 1,357 |

| 7 years later | – | – | – | – | – | – | – | 1,464 | 1,346 |

| 8 years later | – | – | – | – | – | – | – | – | 1,332 |

| Settlements | – | –195 | 155 | 209 | 87 | 8 | –31 | –75 | –168 |

| 11. Insurance business operating expenses | 2018 € million | 2017 € million |

|---|---|---|

| Gross expenses | –2,193 | –2,049 |

| Reinsurers’ share | 21 | 16 |

| Total | –2,172 | –2,033 |

| 12. Administrative expenses | 2018 € million | 2017 € million |

|---|---|---|

| Staff expenses | –10,076 | –10,137 |

| General and administrative expenses | –7,011 | –6,793 |

| Depreciation/amortization and impairment losses | –992 | –954 |

| Total | –18,079 | –17,884 |

| 13. Other net operating income | 2018 € million | 2017 € million |

|---|---|---|

| Gains and losses on non-current assets classified as held for sale and disposal groups | 2 | 126 |

| Other operating income | 1,266 | 979 |

| Other operating expenses | –740 | –995 |

| Total | 528 | 110 |

| 14. Income taxes | 2018 € million | 2017 € million |

|---|---|---|

| Current tax expense | –2,731 | –2,649 |

| Income from/expense on deferred taxes | 362 | –194 |

| Total | –2,369 | –2,843 |

Current taxes in relation to the German limited companies are calculated using an effective corporation tax rate of 15.825 percent based on a corporation tax rate of 15 percent plus the solidarity surcharge. The effective rate for trade tax is 14.35 percent based on an average trade tax multiplier of 410 percent. The tax rates correspond to those for the previous year.

Deferred taxes must be calculated using tax rates expected to apply when the tax asset or liability arises. The tax rates used are therefore those that are valid or have been announced for the periods in question as at the balance sheet date.

| 2018 € million | 2017 € million | |

|---|---|---|

| Profit before taxes | 7,771 | 8,916 |

| Notional rate of income tax of the Cooperative Financial Network (in percent) | 30,175 | 30,175 |

| Income taxes based on notional rate of income tax | –2,345 | –2,690 |

| Tax effects | –24 | –153 |

| Tax effects of tax-exempt income and non-tax deductible expenses | 22 | 192 |

| Tax effects of different tax types, different trade tax multipliers, and changes in tax rates | 14 | –8 |

| Tax effects of different tax rates in other countries | –20 | –74 |

| Current and deferred taxes relating to prior reporting periods | 32 | –3 |

| Change in deferred tax assets due to valuation adjustments | 3 | –92 |

| Other tax effects | –75 | –168 |

| Total | –2,369 | –2,843 |

The table shows a reconciliation from notional income taxes to recognized income taxes based on application of the current tax law in Germany.

D Balance sheet disclosures

| 15. Cash and cash equivalents | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Cash on hand | 8.102 | 7.672 |

| Balances with central banks and other government institutions | 67.067 | 55.9971 |

| Total | 75.169 | 63.669 |

1 Adjustment by €+31,075 million due to change in presentation.

| 16. Loans and advances to banks and customers | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Loans and advances to banks | 18,800 | 19,967 |

| Repayable on demand | 8,419 | 8,9311 |

| Other loans and advances | 10,381 | 11,036 |

| Mortgage loans and other loans secured by mortgages on real estate | 60 | 60 |

| Local authority loans | 5,814 | 6,783 |

| Finance leases | – | 22 |

| Other loans and advances | 4,507 | 4,171 |

| Loans and advances to customers | 794,916 | 761,880 |

| Mortgage loans and other loans secured by mortgages on real estate | 325,468 | 308,329 |

| Local authority loans | 31,699 | 34,889 |

| Home savings loans advanced by building society | 45,454 | 41,005 |

| Finance leases | 2,017 | 2,918 |

| Other loans and advances | 390,278 | 374,739 |

1 Adjustment by €–31,075 million due to change in presentation.

| 17. Hedging instruments (positive and negative fair values) | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Derivatives | 883 | 1,096 |

| for fair value hedges | 883 | 1,086 |

| for cash flow hedges | – | 8 |

| for hedges of net investments in foreign operations | – | 2 |

| Derivatives (negative fair values) | 5,962 | 7,086 |

| for fair value hedges | 5,962 | 7,083 |

| for cash flow hedges | – | 3 |

| 18. Financial assets held for trading | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Derivatives (positive fair values) | 15,647 | 17,101 |

| Interest-linked contracts | 13,773 | 14,749 |

| Currency-linked contracts | 1,194 | 813 |

| Share- and index-linked contracts | 403 | 256 |

| Credit derivatives | 225 | 367 |

| Other contracts | 52 | 916 |

| Securities | 11,790 | 10,429 |

| Bonds and other fixed-income securities | 10,788 | 9,013 |

| Shares and other variable-yield securities | 1,002 | 1,416 |

| Loans and advances | 9,714 | 10,242 |

| Inventories and trade receivables | 349 | 334 |

| Other assets held for trading | – | 1 |

| Total | 37,500 | 38,107 |

| 19. Investments | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Securities | 234,813 | 239,819 |

| Bonds and other fixed income securities | 171,621 | 179,296 |

| Shares and other variable-yield securities | 63,192 | 60,523 |

| Investments in subsidiaries | 1,618 | 1,471 |

| Equity investments | 2,652 | 2,442 |

| Investments in joint ventures | 462 | 525 |

| Investments in associates | 289 | 318 |

| Other shareholdings | 1,901 | 1,599 |

| Total | 239,083 | 243,732 |

| 20. Loss allowances for loans and advances to banks | Stage 1 € million | Stage 2 € million | Stage 3 € million | POCI € million | Total € million |

|---|---|---|---|---|---|

| Balance as at Jan. 1, 2018 | 202 | 16 | 22 | – | 240 |

| Additions | 15 | 12 | 3 | – | 30 |

| Reversals | –17 | –14 | –22 | – | –53 |

| Balance as at Dec. 31, 2018 | 200 | 14 | 3 | – | 217 |

| Loss allowances for loans and advances to customers | Stage 1 € million | Stage 2 € million | Stage 3 € million | POCI € million | Total € million |

|---|---|---|---|---|---|

| Balance as at Jan. 1, 2018 | 955 | 1,903 | 6,389 | 11 | 9,258 |

| Additions | 310 | 798 | 2,159 | 18 | 3,285 |

| Utilizations | – | –1 | –1,129 | – | –1,130 |

| Reversals | –461 | –337 | –2,024 | –25 | –2,847 |

| Other changes | 149 | –211 | 74 | –1 | 11 |

| Balance as at Dec. 31, 2018 | 953 | 2,152 | 5,469 | 3 | 8,577 |

| Loss allowances for investments | Stage 1 € million | Stage 2 € million | Stage 3 € million | POCI € million | Total € million |

|---|---|---|---|---|---|

| Balance as at Jan. 1, 2018 | 57 | 125 | 24 | – | 206 |

| Additions | 41 | 86 | 1 | – | 128 |

| Utilizations | – | – | –1 | – | –1 |

| Reversals | –31 | –102 | –8 | – | –141 |

| Other changes | –1 | 2 | 1 | – | 2 |

| Balance as at Dec. 31, 2018 | 66 | 111 | 17 | – | 194 |

| Comparative information in accordance with IAS 39 | Specific loan loss allowance € million | Portfolio loan loss allowance € million | Total € million |

|---|---|---|---|

| Balance as at Jan. 1, 2018 | 6,530 | 990 | 7,520 |

| Additions | 2,410 | 226 | 2,636 |

| Utilizations | –795 | –1 | –796 |

| Reversals | –1,589 | –305 | –1,894 |

| Changes in the scope of consolidation | –28 | – | –28 |

| Other changes | –79 | 4 | –75 |

| Balance as at Dec. 31, 2018 | 6,449 | 914 | 7,363 |

| 21. Investments held by insurance companies | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Investment property | 2,842 | 2,539 |

| Investments in subsidiaries, joint ventures and associates | 776 | 715 |

| Mortgage loans | 9,307 | 9,142 |

| Promissory notes and loans | 7,083 | 7,342 |

| Registered bonds | 9,076 | 8,800 |

| Other loans | 653 | 721 |

| Variable-yield securities | 9,186 | 9,276 |

| Fixed-income securities | 48,764 | 44,808 |

| Derivatives (positive fair values) | 168 | 299 |

| Loss allowances | –4 | |

| Deposits with ceding insurers | 294 | 240 |

| Assets related to unit-linked contracts | 11,710 | 11,549 |

| Total | 99,855 | 95,431 |

In the previous year, the loss allowance was not presented separately, but deducted from the individual items.

| 22. Property, plant and equipment, and investment property | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Land and buildings | 6,693 | 6,756 |

| Office furniture and equipment | 1,361 | 1,403 |

| Assets subject to operating leases | 72 | 138 |

| Investment Property | 258 | 254 |

| Other fixed assets | 3,857 | 3,180 |

| Total | 12,241 | 11,731 |

| 23. Income tax assets and liabilities | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Income tax assets | 4,359 | 2,980 |

| Current income tax assets | 909 | 896 |

| Deferred tax assets | 3,450 | 2,084 |

| Income tax liabilities | 1,408 | 1,183 |

| Current income tax liabilities | 856 | 813 |

| Deferred tax liabilities | 552 | 370 |

| Deferred tax assets Dec. 31, 2018 € million | Deferred tax assets Dec. 31, 2017 € million | Deferred tax liabilities Dec. 31, 2018 € million | Deferred tax liabilities Dec. 31, 2017 € million | |

|---|---|---|---|---|

| Tax loss carryforwards | 39 | 103 | ||

| Loans and advances to banks and customers | 130 | 51 | 350 | 139 |

| Financial assets and liabilities held for trading, derivatives used for hedging (positive and negative fair values) | 634 | 525 | 197 | 20 |

| Investments | 298 | 298 | 249 | 518 |

| Loss allowances | 900 | 2 | ||

| Investments held by insurance companies | 123 | 53 | 641 | 676 |

| Deposits from banks and customers | 277 | 374 | 239 | 198 |

| Debt certificates including bonds | 151 | 46 | 4 | 6 |

| Provisions | 2,151 | 2,138 | 50 | 38 |

| Insurance liabilities | 78 | 75 | 195 | 399 |

| Other balance sheet items | 192 | 182 | 148 | 137 |

| Total (gross) | 4,973 | 3,845 | 2,075 | 2,131 |

| Netting of deferred tax assets and deferred tax liabilities | –1,523 | –1,761 | –1,523 | –1,761 |

| Total (net) | 3,450 | 2,084 | 552 | 370 |

Deferred tax assets and liabilities are recognized for temporary differences in respect of the balance sheet items shown in the table as well as for tax loss carryforwards.

In the previous year, the loss allowance, which is reported separately in the year under review, was included in loans and advances to banks and customers.

| 24. Other assets | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Other assets held by insurance companies | 3,372 | 3,090 |

| Goodwill | 59 | 58 |

| Other intangible assets | 551 | 463 |

| Prepaid expenses | 184 | 162 |

| Other receivables | 3,560 | 3,485 |

| Non-current assets and disposal groups classified as held for sale | 7,133 | 84 |

| Fair value changes of the hedged items in portfolio hedges of interest-rate risk | 4,000 | 4,128 |

| Residual other assets | 500 | 616 |

| Total | 19,359 | 12,086 |

The breakdown of other assets held by insurance companies is as follows:

| Dec. 31, 2018 € million | Dec. 31, 2017 € million | |

|---|---|---|

| Intangible assets | 140 | 151 |

| Reinsurers’ share of insurance liabilities | 139 | 168 |

| Provision for unearned premiums | 6 | 11 |

| Benefit reserves | 36 | 60 |

| Provisions for claims outstanding | 97 | 97 |

| Loans and advances | 1,650 | 679 |

| Receivables arising out of direct insurance operations | 450 | 305 |

| Receivables arising out of reinsurance operations | 271 | 294 |

| Other receivables | 929 | 80 |

| Credit balances with banks, checks and cash on hand | 409 | 110 |

| Residual other assets | 1,036 | 1,982 |

| Property, plant and equipment | 379 | 387 |

| Prepaid expenses | 34 | 31 |

| Remaining assets held by insurance companies | 623 | 1,564 |

| Loss allowances | –2 | |

| Total | 3,372 | 3,090 |

In the previous year, the loss allowance was not presented separately, but deducted from the individual items.

| 25. Deposits from banks and customers | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Deposits from banks | 119,300 | 113,065 |

| Repayable on demand | 10,733 | 7,664 |

| With agreed maturity or notice period | 108,567 | 105,401 |

| Deposits from customers | 842,420 | 801,031 |

| Savings deposits and home savings deposits | 246,029 | 242,345 |

| Savings deposits with agreed notice period of three months | 177,790 | 175,547 |

| Savings deposits with agreed notice period of more than three months | 8,242 | 10,156 |

| Home savings deposits | 59,997 | 56,642 |

| Other deposits from customers | 596,391 | 558,686 |

| Repayable on demand | 488,884 | 450,264 |

| With agreed maturity or notice period | 107,507 | 108,422 |

| 26. Debt certificates issued including bonds | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Bonds issued | 43,110 | 47,696 |

| Mortgage Pfandbriefe | 33,737 | 30,390 |

| Public-sector Pfandbriefe | 2,683 | 3,548 |

| Other bonds | 6,690 | 13,758 |

| Other debt certificates issued | 13,001 | 17,111 |

| Total | 56,111 | 64,807 |

| 27. Financial liabilities held for trading | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Derivatives (negative fair values) | 16,080 | 16,813 |

| Interest-linked contracts | 12,100 | 13,848 |

| Currency-linked contracts | 1,975 | 871 |

| Share- and index-linked contracts | 1,853 | 742 |

| Credit derivatives | 74 | 77 |

| Other contracts | 78 | 1,275 |

| Short positions | 1,102 | 617 |

| Bonds issued including share- and index- and other debt certificates | 20,250 | 13,028 |

| Liabilities | 4,866 | 6,255 |

| Liabilities from commodities transactions and commodity lending | 53 | 47 |

| Total | 42,451 | 36,760 |

| 28. Provisions | Dec. 31, 2018 € million |

|---|---|

| Provisions for defined benefit plans | 7,407 |

| Provisions for loan commitments | 222 |

| Provisions for financial guarantee contracts | 137 |

| Other provisions for loans and advances | 39 |

| Provisions relating to building society operations | 1,072 |

| Residual provisions | 3,488 |

| Total | 12,365 |

| Comparative information in accordance with IAS 39 | Dec. 31, 2017 € million |

|---|---|

| Provisions for defined benefit plans | 7,630 |

| Provisions for loans and advances | 419 |

| Provisions relating to building society operations | 983 |

| Residual provisions | 3,530 |

| Total | 12,562 |

| Funding status of defined benefit obligations | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Present value of defined benefit obligations not funded by plan assets | 6,831 | 6,924 |

| Present value of defined benefit obligations funded by plan assets | 2,732 | 2,722 |

| Present value of defined benefit obligations | 9,563 | 9,646 |

| less fair value of plan assets | –2,158 | –2,016 |

| Defined benefit obligations (net) | 7,405 | 7,630 |

| Recognized surplus | 2 | – |

| Provisions for defined benefit plans | 7,407 | 7,630 |

| Changes in the present value of defined benefit obligations | 2018 € million | 2017 € million |

|---|---|---|

| Present value of defined benefit obligations as at Jan. 1 | 9,646 | 9,464 |

| Current service cost | 109 | 136 |

| Interest expense | 169 | 165 |

| Pension benefits paid including plan settlements | –354 | –353 |

| Past service cost | – | –2 |

| Actuarial gains (–)/losses (+) | –34 | 243 |

| Other changes | 27 | –7 |

| Present value of defined benefit obligations as at Dec. 31 | 9,563 | 9,646 |

| Changes in plan assets | 2018 € million | 2017 € million |

|---|---|---|

| Fair value of plan assets as at Jan. 1 | 2,016 | 1,239 |

| Interest income | 37 | 24 |

| Contributions to plan assets | 231 | 814 |

| Pension benefits paid | –69 | –65 |

| Return on plan assets (excluding interest income) | –65 | 14 |

| Other changes | 8 | –10 |

| Fair value of plan assets as at Dec. 31 | 2,158 | 2,016 |

| Actuarial assumptions used for defined benefit obligations | Dec. 31, 2018 (percent) | Dec. 31, 2017 (percent) |

|---|---|---|

| Weighted discount rate | 1.75 | 1.75 |

| Weighted salary increase | 1.98 | 1.99 |

| Weighted pension increase | 1.92 | 1.93 |

| 29. Insurance liabilities | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Provision for unearned premiums | 1,171 | 1,169 |

| Benefit reserve | 61,709 | 58,670 |

| Provision for claims outstanding | 12,079 | 11,064 |

| Provision for premium refunds | 8,283 | 8,446 |

| Other insurance liabilities | 64 | 68 |

| Reserve for unit-linked insurance contracts | 9,946 | 9,907 |

| Total | 93,252 | 89,324 |

| Change in provision for unearned premiums | 2018 € million | 2017 € million |

|---|---|---|

| Balance as at Jan. 1 | 1,169 | 1,119 |

| Additions | 1,235 | 1,235 |

| Utilizations/reversals | –1,228 | –1,176 |

| Changes attributable to currency translation | –5 | –9 |

| Balance as at Dec. 31 | 1,171 | 1,169 |

| Change in benefit reserve | 2018 € million | 2017 € million |

|---|---|---|

| Balance as at Jan. 1 | 58,670 | 55,167 |

| Additions | 5,876 | 6,255 |

| Interest component | 1,045 | 1,067 |

| Utilizations / reversals | –3,882 | –3,818 |

| Changes attributable to currency translation | – | –1 |

| Balance as at Dec. 31 | 61,709 | 58,670 |

Supplementary change-in-discount-rate reserves totaling €3,306 million have been recognized for policies with a discount rate in excess of the reference rate specified in the German Regulation on the Principles Underlying the Calculation of the Premium Reserve (DeckRV) (December 31, 2017: €2,998 million).

| Change in the provision for claims outstanding | 2018 € million | 2017 € million |

|---|---|---|

| Balance as at Jan. 1 | 11,064 | 10,071 |

| Claims expenses | 6,650 | 6,175 |

| Less payments | –5,630 | –5,078 |

| Changes attributable to currency translation | –5 | –104 |

| Balance as at Dec. 31 | 12,079 | 11,064 |

| Change in the provision for premium refunds | 2018 € million | 2017 € million |

|---|---|---|

| Balance as at Jan. 1 | 8,446 | 8,918 |

| Adjustments due to first-time application of IFRS 9 | 1,694 | |

| Balance as at Jan, 1 adjusted | 10,140 | 8,918 |

| Additions | 878 | 672 |

| Utilizations/reversals | –705 | –1,290 |

| Changes resulting from unrealized gains and losses on investments (through other comprehensive income) | –1,488 | –136 |

| Changes resulting from other remeasurements (through profit or loss) | –542 | 316 |

| Changes attributable to currency translation | – | –34 |

| Balance as at Dec. 31 | 8,283 | 8,446 |

The breakdown of maturities for insurance liabilities is shown in the following tables:

| ≤ 1 year € million | > 1 year – 5 years € million | > 5 years € million | Indefinite € million | |

|---|---|---|---|---|

| Balance as at December 31, 2018 | ||||

| Provision for unearned premiums | 950 | 166 | 55 | – |

| Benefit reserve | 1,810 | 6,178 | 13,050 | 40,671 |

| Provision for claims outstanding | 4,388 | 4,301 | 3,390 | – |

| Provision for premium refunds | 833 | 644 | 713 | 6,093 |

| Other insurance liabilities | 41 | 13 | 7 | 3 |

| Total | 8,022 | 11,302 | 17,215 | 46,767 |

| Balance as at December 31, 2017 | ||||

| Provision for unearned premiums | 1,011 | 124 | 34 | – |

| Benefit reserve | 1,677 | 6,601 | 13,258 | 37,134 |

| Provision for claims outstanding | 4,764 | 3,608 | 2,692 | – |

| Provision for premium refunds | 763 | 632 | 754 | 6,297 |

| Other insurance liabilities | 46 | 14 | 5 | 3 |

| Total | 8,261 | 10,979 | 16,743 | 43,434 |

| 30. Other liabilities | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Other liabilities of insurance companies | 5,806 | 5,464 |

| Other liabilities and accruals | 2,462 | 2,318 |

| Liabilities included in disposal groups classified as held for sale | 281 | – |

| Fair value changes of the hedged items in portfolio hedges of interest-rate risk | 329 | 335 |

| Residual other liabilities | 586 | 757 |

| Total | 9,464 | 8,874 |

The breakdown of other liabilities of insurance companies is as follows:

| Dec. 31, 2018 € million | Dec. 31, 2017 € million | |

|---|---|---|

| Residual provisions | 373 | 354 |

| Provisions for employee benefits | 336 | 317 |

| Provisions for share-based payment transactions | 2 | 1 |

| Other provisions | 35 | 36 |

| Payables and residual other liabilities | 5,433 | 5,110 |

| Subordinated capital | 87 | 85 |

| Deposits received from reinsurers | 43 | 75 |

| Payables arising out of direct insurance operations | 1,500 | 1,465 |

| Payables arising out of reinsurance operations | 342 | 269 |

| Debt certificates issued including bonds | 30 | 30 |

| Deposits from banks | 580 | 596 |

| Derivatives (negative fair values) | 11 | 39 |

| Liabilities from capitalization transactions | 2,086 | 1,861 |

| Other liabilities | 120 | 199 |

| Residual other liabilities | 634 | 491 |

| Total | 5,806 | 5,464 |

| 31. Subordinated capital | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Subordinated liabilities | 2,566 | 3,774 |

| Profit-sharing rights | 161 | 391 |

| Share capital repayable on demand | 13 | 21 |

| Total | 2,740 | 4,186 |

| 32. Equity Breakdown of subscribed capital | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Cooperative shares | 12,085 | 11,672 |

| Share capital | 178 | 178 |

| Capital of silent partners | 69 | 80 |

| Total | 12,332 | 11,930 |

The capital reserves comprise the amounts by which the notional value of the shares of the corporations included in the consolidated financial statements was exceeded upon the issuance of the shares.

Retained earnings contain the undistributed equity earned by the companies included in the consolidated financial statements as well as the gains and losses arising on remeasurements of defined benefit plans after taking into account deferred taxes.

Reserves from other comprehensive income consist of the following items:

| € million | No reclassification to the income statement Reserve from equity instruments for which the fair value OCI option has ben exercised | No reclassification to the income statement Reserve from gains and losses on financial liabilities for which the fair value option has been exercised, attributable to changes in own credit risk | Reclassification to the income statement Reserve from debt instruments measured at fair value through other comprehensive income | Reclassification to the income statement Revaluation reserve | Reclassification to the income statement Cash flow hedge reserve | Reclassification to the income statement Currency translation reserve |

|---|---|---|---|---|---|---|

| Equity as at Jan. 1, 2017 | 1.720 | –10 | 74 | |||

| Other comprehensive income/loss | –30 | 15 | –28 | |||

| Total comprehensive income | –30 | 15 | –28 | |||

| Changes in the scope of consolidation | –14 | – | – | |||

| Equity as at Dec. 31, 2017 | 1.676 | 5 | 46 | |||

| First-time application of IFRS 9 in the consolidated financial statements | 465 | 724 | –1.676 | |||

| Adjusted equity as at Jan. 1, 2018 | 465 | 724 | – | 5 | 46 | |

| Other comprehensive income/loss | 1 | 22 | –413 | – | –5 | 28 |

| Total comprehensive income | 1 | 22 | –413 | –5 | 28 | |

| Changes in the scope of consolidation | – | – | – | 1 | 11 | |

| Acquisition/disposal of non-controlling interests | 5 | – | 6 | – | – | |

| Reclassifications within equity | –33 | – | – | – | – | |

| Equity as at Dec. 31, 2018 | 438 | 22 | 317 | 1 | 85 |

E Financial instruments disclosures

| 33. Fair value of financial instruments | Carrying amount Dec. 31, 2018 € million | Fair value Dec. 31, 2018 € million | Carrying amount Dec. 31, 2017 € million | Fair value Dec. 31, 2017 € million |

|---|---|---|---|---|

| Assets | ||||

| Cash and cash equivalents | 67,067 | 67,067 | 55,9974 | 55,9974 |

| Loans and advances to banks1 | 18,583 | 20,471 | 19,9485 | 21,1985 |

| Loans and advances to customers1 | 786,339 | 788,727 | 754,536 | 756,447 |

| Hedging instruments (positive fair values) | 883 | 883 | 1,096 | 1,096 |

| Financial assets held for trading2 | 37,151 | 37,151 | 37,773 | 37,773 |

| Investments1,3 | 238,138 | 239,950 | 242,889 | 243,064 |

| Investments held by insurance companies1,2,3 | 85,009 | 85,562 | 81,086 | 81,936 |

| Other assets2 | 8,897 | 8,366 | 7,575 | 7,849 |

| Equity and liabilities | ||||

| Deposits from banks | 119,300 | 121,346 | 113,065 | 114,502 |

| Deposits from customers | 842,420 | 843,600 | 801,031 | 802,258 |

| Debt certificates issued including bonds | 56,111 | 56,264 | 64,807 | 64,849 |

| Hedging instruments (negative fair values) | 5,962 | 5,962 | 7,086 | 7,086 |

| Financial liabilities held for trading2 | 42,398 | 42,398 | 36,713 | 36,713 |

| Other liabilities2 | 2,878 | 2,745 | 2,653 | 2,542 |

| Subordinated capital | 2,740 | 2,839 | 4,186 | 4,365 |

1 Carrying amounts less loss allowances (in the previous year, the loss allowance for investments, and for investments held by insurance companies was not reported separately).

2 Fair values and carrying amounts are only disclosed for financial instruments.

3 Excluding investments in joint ventures and in associates.

4 Adjustment by €+31,075 million due to change in presentation

5 Adjustment by €–31,075 million due to change in presentation

| 34. Maturity analysis | ≤ 3 months € million | > 3months – 1 year € million | > 1 year € million | Indefinite € million |

|---|---|---|---|---|

| Balance as at December 31, 2017 | ||||

| Loans and advances to banks | 8,314 | 1,821 | 12,959 | 270 |

| Loans and advances to customers | 39,739 | 60,927 | 688,932 | 20,658 |

| Deposits from banks | 34,241 | 10,278 | 80,128 | 790 |

| Deposits from customers | 701,225 | 20,448 | 64,861 | 60,400 |

| Debt certificates issued including bonds | 9,240 | 5,843 | 44,407 | - |

| Balance as at December 31, 2016 | ||||

| Loans and advances to banks | 25,818 | 3,858 | 25,622 | 553 |

| Loans and advances to customers | 36,444 | 57,180 | 666,093 | 19,531 |

| Deposits from banks | 31,076 | 10,266 | 80,021 | 680 |

| Deposits from customers | 660,963 | 19,084 | 70,079 | 57,023 |

| Debt certificates issued including bonds | 12,252 | 7,869 | 45,840 | 236 |

The contractual maturities shown in the above table do not match the estimated actual cash inflows and cash outflows.

F Other disclosures

| 35. Capital requirements and regulatory indicators | Dec. 31, 2018 € million | Dec. 31, 2017 € million |

|---|---|---|

| Total capital | 101,671 | 97,680 |

| Tier 1 capital | 87,272 | 82,191 |

| of which: Common Equity Tier 1 | 86,746 | 81,463 |

| Additional Tier 1 capital | 526 | 728 |

| Tier 2 capital | 14,399 | 15,489 |

| Total risk exposure | 642,352 | 611,490 |

| Common Equity Tier 1 capital ratio (percent) | 13.5 | 13.3 |

| Tier 1 capital ratio (percent) | 13.6 | 13.4 |

| Total capital ratio (percent) | 15.8 | 16.0 |

| Common Equity Tier 1 capital ratio incl. reserves pursuant to Section 340f HGB (percent)1 | 15.5 | 15.4 |

| Tier 1 capital ratio incl. reserves pursuant to Section 340f HGB (percent)1 | 15.6 | 15.6 |

| Leverage ratio (percent)2 | 6.9 | 6.8 |

| Leverage ratio incl. reserves pursuant to Section 340f HGB (percent)1,3 | 7.8 | 7.7 |

1 The balance of reserves pursuant to Section 340f HGB is based on the financial statements data reported for regulatory purposes before additions and reversals within the scope of the 2017 and 2016 financial statements.

2 Disclosure of the leverage ratio of the bank-specific protection system using the transitional definition for Tier 1 capital.

3 Disclosure of ratio after full introduction of the new CRR provisions (fully loaded), subject to the assumption of full reclassification and inclusion of reserves pursuant to Section 340f HGB as Tier 1 capital from a business point of view.

The disclosures relate to the institutional protection scheme (cooperative joint liability scheme) and the respective reporting date. The disclosures relating to own funds and capital requirements are based on the outcome of the extended aggregated calculation in accordance with article 49 (3) CRR in conjunction with article 113 (7) CRR.